How to perform ASC 606 Revenue Recognition Testing using Agentive AI

Learn how to leverage AI-powered contract analysis to streamline revenue recognition testing, focusing on material rights assessment, variable consideration, and performance obligation identification.

Video Tutorial

Overview

Agentive is much more than a simple matching and data extraction tool. Auditors may also leverage Agentive’s AI first design to perform knowledge based testing to increase the efficiency and reduce risk of qualitative audit procedures. By understanding how to deploy AI agents within your audit workflow you will transform auditor performance to focus on areas of greatest complexity and highest risk.

Within this user guide, we explore procedures to leverage AI agents to review Software-as-a-Service contracts to evaluate embedded material rights and the presence of variable consideration. Auditor’s may develop their own methodologies around prompt architecture, but we explore two different approaches as follows:

1. Authoritative Context Defined

Within this approach the auditor thoroughly crafts a prompt that provides the AI agent with the core required context to perform the task. Auditors will explicitly state methodology followed, or relevant guidance from authoritative services.

2. Authoritative Context Not Defined

An auditor may have a more general question where authoritative context is dependent on the result. In this case, the auditor may decide not to predefine the context, but will want to know exactly what resource the AI agent referenced when making its determination.

Start Procedure

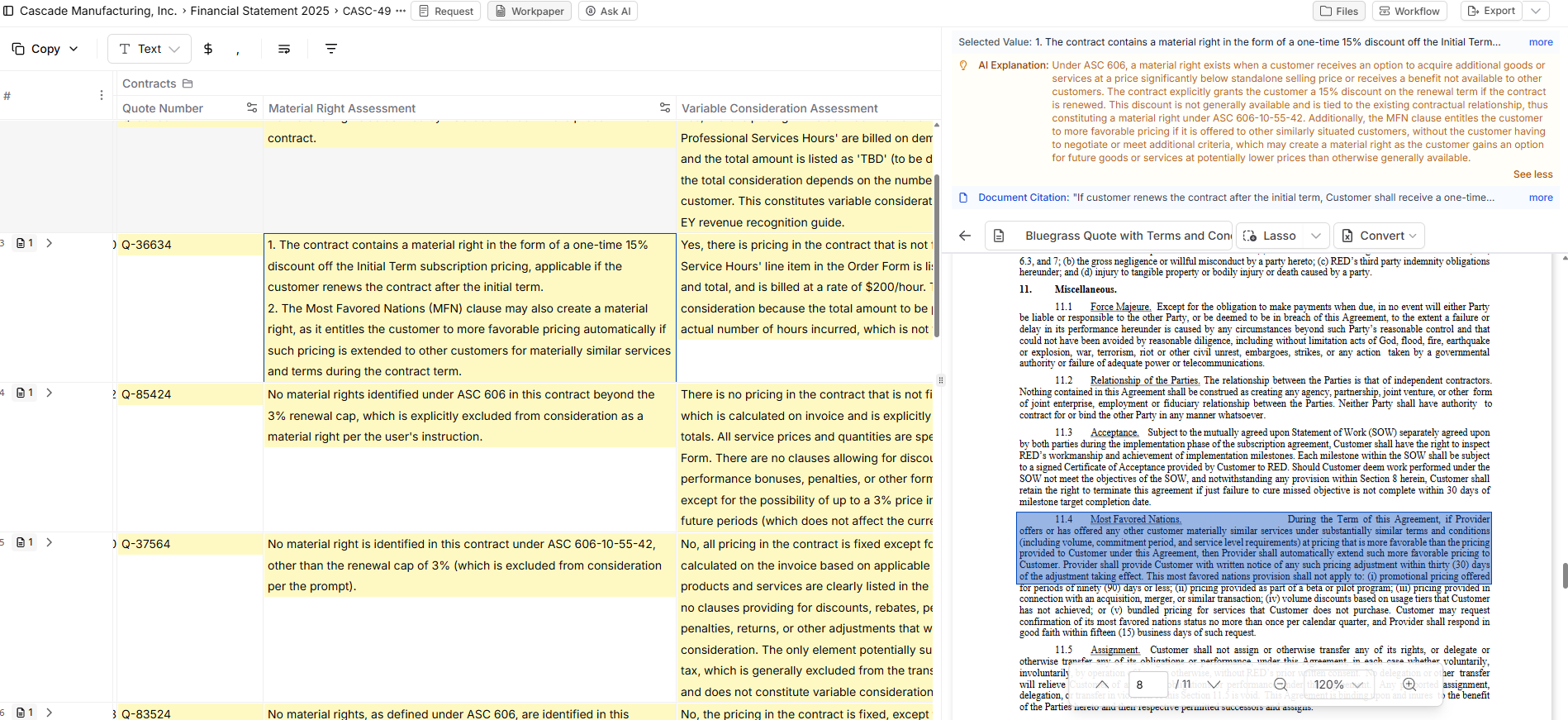

1. Material Rights Assessment — Authoritative Context Defined

Add Custom Prompt

Click “Add Custom Prompt” and name it “Material Rights Assessment”

Structure Your Prompt

Structure your prompt with proper context and guidance:

We are reviewing a SaaS revenue contract to determine under ASC 606. Specifically if the contract contains a material right under ASC 606.

ASC 606-10-55-42 says that if an entity grants a customer the option to acquire additional goods or services, that option gives rise to a performance obligation in the contract only if the option provides a material right to the customer that it would not receive without entering into that contract.

Common material rights occur through sales incentives, customer award credits, contract renewal options, or any other customer discounts on future goods or services including entitlement to optional free services.

Please identify any material rights as described above in the contract.

We have determined that a renewal cap of the lower of 3% or CPI does not meet the definition of a material right, and therefore exclude any conclusion that such language results in a material right.Review Results

AI Explanation: The AI “Explanation” in the top right hand of the screen provides the rationale for the response given as well as references to underlying guidance used to make the determination. This feature helps guide the auditor through the analysis thought process and provides a first draft of a possible explanatory tickmark within the audit workpaper.

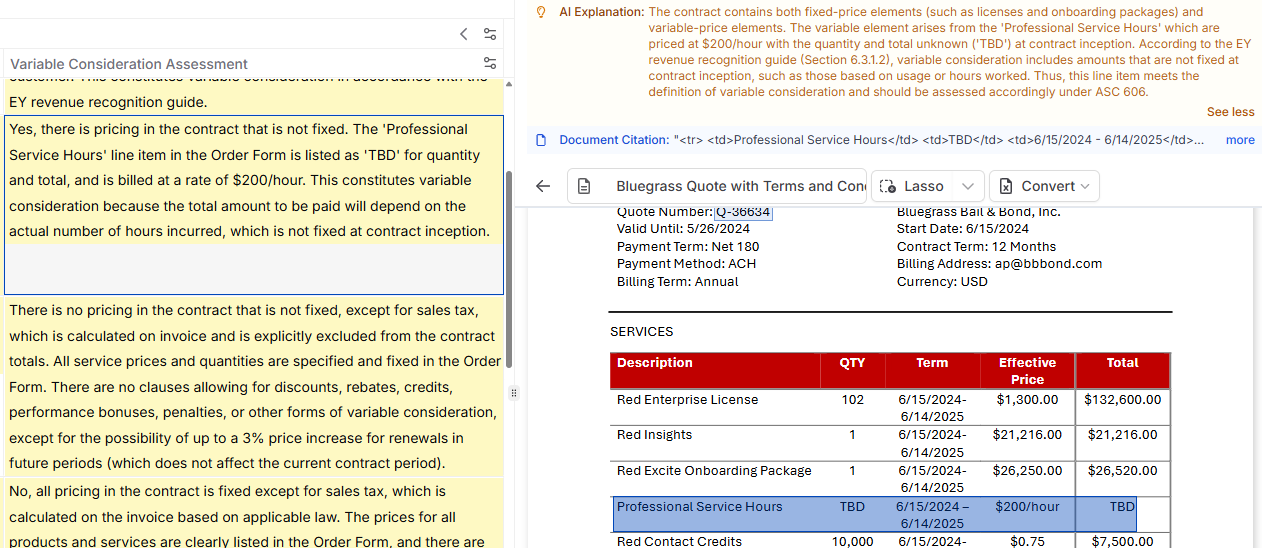

2. Variable Consideration Identification — Context Requested

Add Variable Consideration Prompt

Add another custom prompt for “Variable Consideration Analysis”

Use This Prompt Structure

Is there any pricing in the contract that is not fixed? Reference the exact section and paragraph number of the EY revenue recognition guide that documents variable consideration.Review Results

Guidance Reference: In this example, the auditor asked the AI agent to return the exact reference to the EY guide that describes the appropriate accounting for variable consideration within a revenue contract. The auditor uses this result to point them directly to supporting guidance that they may review to make their final determination on the context of the contract.

Critical Auditor Responsibilities

⚠️ Professional Judgment Required

- • Validate AI conclusions based on professional judgment and client knowledge

- • Consider industry context and business model implications

- • Review highlighted contract sections for accuracy

- • Document reasoning using AI explanations as starting drafts

Example Decision Process: AI identifies a 15% renewal discount as a material right. The auditor must determine:

- Is 15% significant enough to constitute a material right?

- Would customers receive similar discounts in the market?

- How does this align with company’s standard pricing practices?

Template Creation and Reusability

3. Save Testing Templates

Refine and Save

Once prompts are refined and working effectively, save as a template

Name for Identification

Name the template for easy identification (e.g., “SaaS Revenue Testing - ASC 606”)

Share Across Teams

Share templates across engagement teams for consistency

Customize by Context

Customize templates by industry or client type as needed

4. Benefits of Template Approach

Efficiency Gains

- • Rapid deployment on new engagements

- • Consistent testing approaches across teams

- • Reduced setup time for contract analysis

- • Standardized prompt quality and context

Quality Improvements

- • Proven prompt structures that work effectively

- • Consistent identification of high-risk areas

- • Reduced variation in testing approaches

- • Better training tool for junior staff

Key Benefits and Results

Time Savings

- Faster contract review

- Automated deviation highlighting

- Consistent testing across samples

- Reduced manual reading

Risk Focus

- AI directs to high-risk provisions

- Standardized complex area ID

- Comprehensive coverage

- More time for judgment areas

Team Development

- Knowledge transfer via prompts

- Consistent ASC 606 training

- Better resource allocation

- Enhanced learning through AI

Audit Quality

- Comprehensive coverage

- Consistent approaches

- Detailed documentation

- Reduced oversight risk

6. Continuous Improvement

Best Practices

- ✓Monitor AI accuracy and refine prompts based on results

- ✓Share successful templates and approaches across teams

- ✓Track efficiency gains and quality improvements

- ✓Update prompts as standards and interpretations evolve